Resources

Aging & retirement

Learn more about the topic affecting retirees.

special netflix series

How to Live to 100, Wherever You Are in the World

Dan Buettner’s Secrets of the Blue Zones docuseries and the 12 habits that may add years to your life.

Retirement related resources

Administration on Aging

Center for Retirement Research at Boston College

Boettner Center for Pensions and Retirement Security

National Retirement Planning Coalition

University of Michigan Retirement Research Center

National Bureau of Economic Research

National Institute on Aging

AARP Research

Journal of Financial Planning

Social Security Retirement Research Consortium

Social Security Administration

The Individual Finance and Individual Centre

National Council on Aging

Commission on Accreditation of Rehabilitation Facilities

Home Equity Conversion Mortgages

Process to mitigate longevity and conditions within longevity

MRT Framework

retirement goals

Modern retirement theory evaluates unknowable risks through a priority of goals.

Each goal builds upon the other to plan for an unknowable longevity and conditions within longevity.

Decision framework

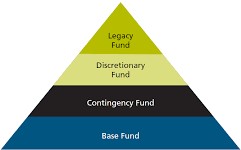

MRT decision framework uses four prioritized funds to solve against individually unknowable retirement risks.

Start with essential expenses by matching 3-S Income. Then, evaluate and plan with the 3-R Contingency Risk matrix.

4 Funds

The base fund matches retirement’s essential expenses with stable, secure, and sustainable income.

The contingency fund serves to mitigate the unknown through insurance and hedging strategies.

The discretionary fund consists of delayable, non-essential expenses.

The legacy fund is the remaining resources.