Journal of Financial Planning

- Modern Retirement Theory: Reaching Client Goals in Every Market, December 2009

- Using a Hierarchy of Funds to Reach Client Goals, December 2010

- Crafting Retirement Income that Stable, Secure, and Sustainable, December 2017

- Contingency Fund: Individual Retiree Risk Management, December 2022

Reprinted with permission by the Financial Planning Association, Journal of Financial Planning. For additional information on the Financial Planning Association, please visit www.onefpa.org or call 1.800.322.4237.

Articles

Advisor Perspectives

The Markowitz Conundrum

By contrasting features of Markowitz 1952 with Markowitz 1991, we offer an evaluation matrix as a tool that challenges the suitability of the advisory industry’s application of MPT investing for an individual’s portfolio.

Advisor Perspectives

The Markowitz Conundrum Part II

By contrasting multiple features of Markowitz 1952 with Markowitz 1991, we offer an evaluation matrix as a tool that challenges the suitability of the advisory industry’s application of modern portfolio theory (MPT) investing for an individual’s portfolio. We hope this comparison matrix will encourage advisors to re-think the current default application of MPT for the individual investor.

Advisor Perspectives

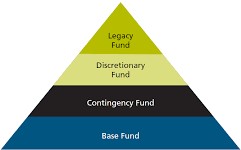

Why Advisors Should Distinguish Base and Discretionary Expenses in Retirement

The difference in Base (mandatory or essential expenses) and Discretionary (voluntary or non- essential) expenses in retirement is fundamental and consequential. In practice, the distinction between Base and Discretionary expenses may be the most important decision a retiree must make to use assets efficiently and effectively in retirement income planning. Some advisors fail to highlight the difference between expense categories and claim that clients do not see food, shelter, insurance differently than country club dues or vacation cruises, hence the expense categories are combined and called ‘lifestyle expenses’. In our view, this is a distortion of affluence.

Retirement Investor.io

Cracking Modern Portfolio Theory’s Enigma Code with Dedicated Portfolios for Individual Retirees

In investing, modern portfolio theory often appears to investors like an encryption machine. Most portfolio managers use modern portfolio theory to build their models, yet assumptions made by each adviser lead to widely varied models about how successful investing portfolios should be constructed.